Spotting the Next Big Investment: Your Guide to Staying Ahead of the Curve

Ever dreamed of discovering the next Apple or Amazon before everyone else? You're not alone. We all want that golden ticket to financial success. But let's be real - there's no magic formula. Still, with the right strategies and a keen eye, you might just stumble upon the next big thing.

Let's dive into the world of investment trends and see if we can uncover some hidden gems.

Market Trends: The Crystal Ball of Investing

Picture this: you're at a party, and everyone's talking about the latest AI chatbot. That's not just small talk - it's a market trend in action. Right now, generative AI is the belle of the ball, promising to revolutionize everything from your doctor's office to your bank.

Investors are going gaga over AI-focused ETFs. It's like they're all trying to catch the next wave before it hits the shore. But remember, not every shiny new trend turns to gold.

The Underdog Sectors: Don't Judge a Book by Its Cover

Sometimes, the real treasures are hiding in plain sight. Take small-cap stocks, for instance. They're like the scrappy underdogs of the stock market. While everyone's been fawning over the tech giants, these little guys have been quietly growing in the shadows.

Sure, they might not have the deep pockets of the big players, but they've got hustle. And sometimes, that's all you need to hit it big.

Show Me the Money: High-Yield Investments

With interest rates on the rise, fixed-income investments are making a comeback. It's like your grandma's savings account is suddenly cool again. High-yield savings accounts and CDs are offering returns that'll make your eyes pop - we're talking over 5% in some cases.

Even Treasury bills are getting in on the action. It's like the boring kids at school suddenly became the life of the party.

Emerging Themes: The New Kids on the Block

Keep your eyes peeled for the up-and-comers. Cybersecurity, for example, is hot right now. With hackers getting craftier by the day, companies that can keep our data safe are in high demand.

And have you heard about synthetic biology? It sounds like something out of a sci-fi movie, but it's real, and it's promising to shake things up in the biotech world.

Think Long-Term: Slow and Steady Wins the Race

Investing isn't a sprint; it's a marathon. The real winners are often the ones who play the long game. They look for companies that are riding long-term trends and have built themselves a nice, cozy economic moat to keep competitors at bay.

Take dividend growth investing, for instance. It's like planting a money tree that keeps growing year after year. Companies that have been upping their dividends for 10+ years? They're the real MVPs.

Do Your Homework: Research is Key

Finding the next big investment isn't about luck - it's about putting in the work. Use stock screeners to sift through the noise and find the diamonds in the rough. But don't just stop at the numbers. Dig deeper. Understand the business. Know the competition.

It's like dating - you wouldn't commit after just one Tinder profile pic, would you?

Stay in the Loop: Knowledge is Power

To spot the next big thing, you've got to keep your ear to the ground. Read everything you can get your hands on - news, blogs, forums, you name it. Join online investing communities. It's like having a whole team of scouts working for you.

Watch the Crowd: Consumer Trends Tell a Story

Sometimes, the best investment ideas are right under your nose. Watch how people use products and services. Remember when everyone and their grandma started buying iPhones? That was a pretty big clue about where Apple was headed.

Safety First: Build Your Foundation

Before you start chasing the next big thing, make sure you've got your basics covered. Build up that emergency fund - aim for enough to cover six months of expenses. It's like having a financial safety net.

And don't overlook good old index funds. They might not be sexy, but they're reliable. It's like having a dependable friend who's always got your back.

Hype vs. Reality: Don't Believe Everything You Hear

Not every "hot tip" is worth your time. Learn to separate the wheat from the chaff. Sometimes, the real opportunities are in the less glamorous sectors. Banking might not sound as exciting as AI, but it could be where the real money's at.

Learn from History: What Goes Around, Comes Around

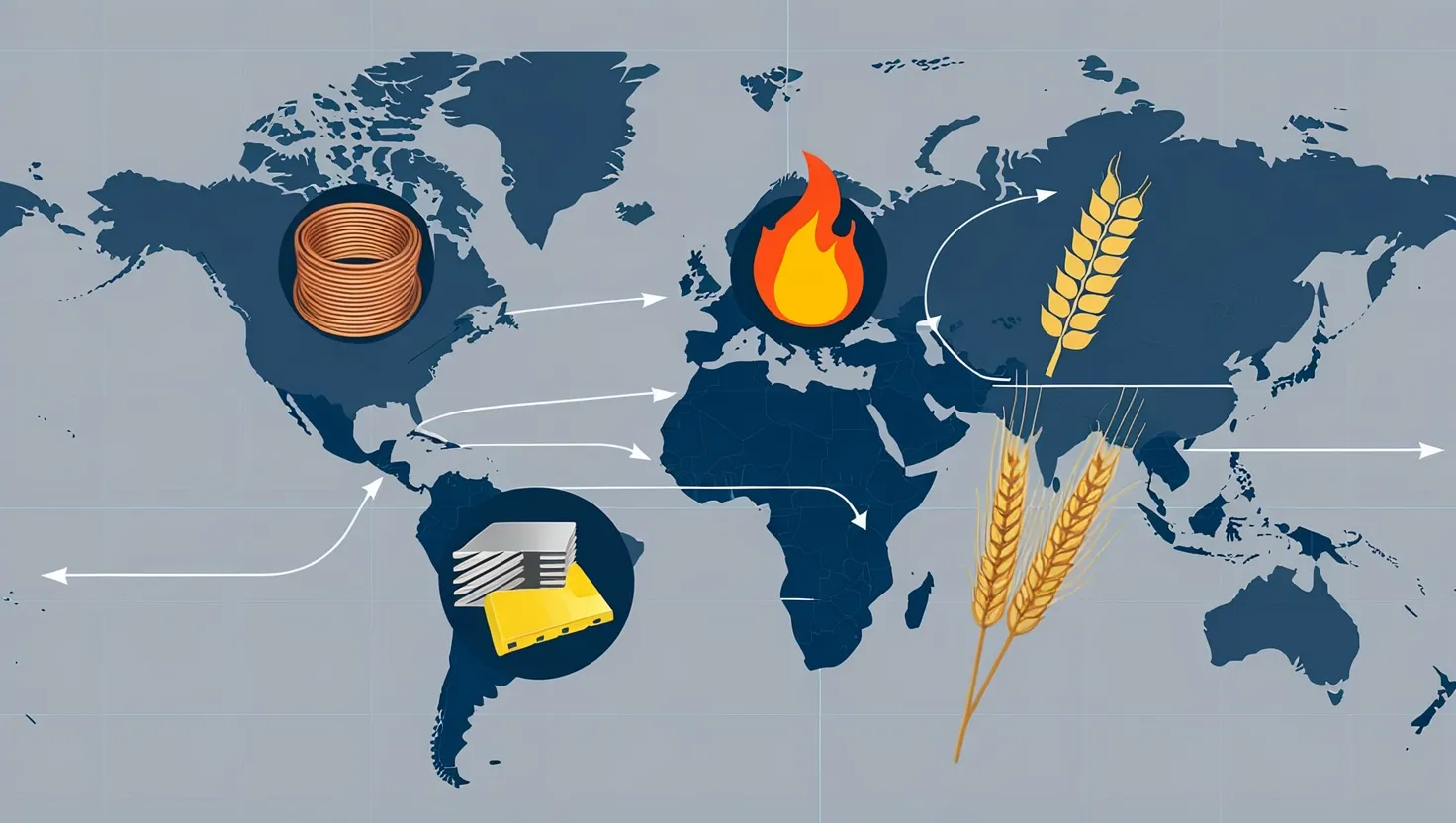

Looking back can sometimes help you see ahead. Major shifts in the market have often led to huge opportunities. Remember when international stocks were all the rage in the 70s? Or when US stocks took off in the 90s? History doesn't repeat, but it often rhymes.

Make It Personal: Find Your Investing Style

Investing isn't one-size-fits-all. You've got to find what works for you. Maybe you're all about those steady dividend growers. Or perhaps you prefer the set-it-and-forget-it approach of index funds. Whatever floats your boat, just make sure you can stick with it when the seas get rough.

The Bottom Line

Spotting the next big investment isn't easy, but it's not impossible either. It's about keeping your eyes open, doing your homework, and having the patience to play the long game. Stay informed, watch for trends, and always look beyond the hype.

Remember, investing is a journey, not a destination. It's about building wealth over time, not getting rich quick. So strap in, enjoy the ride, and who knows? You might just find yourself ahead of the curve, ready to catch the next big wave.