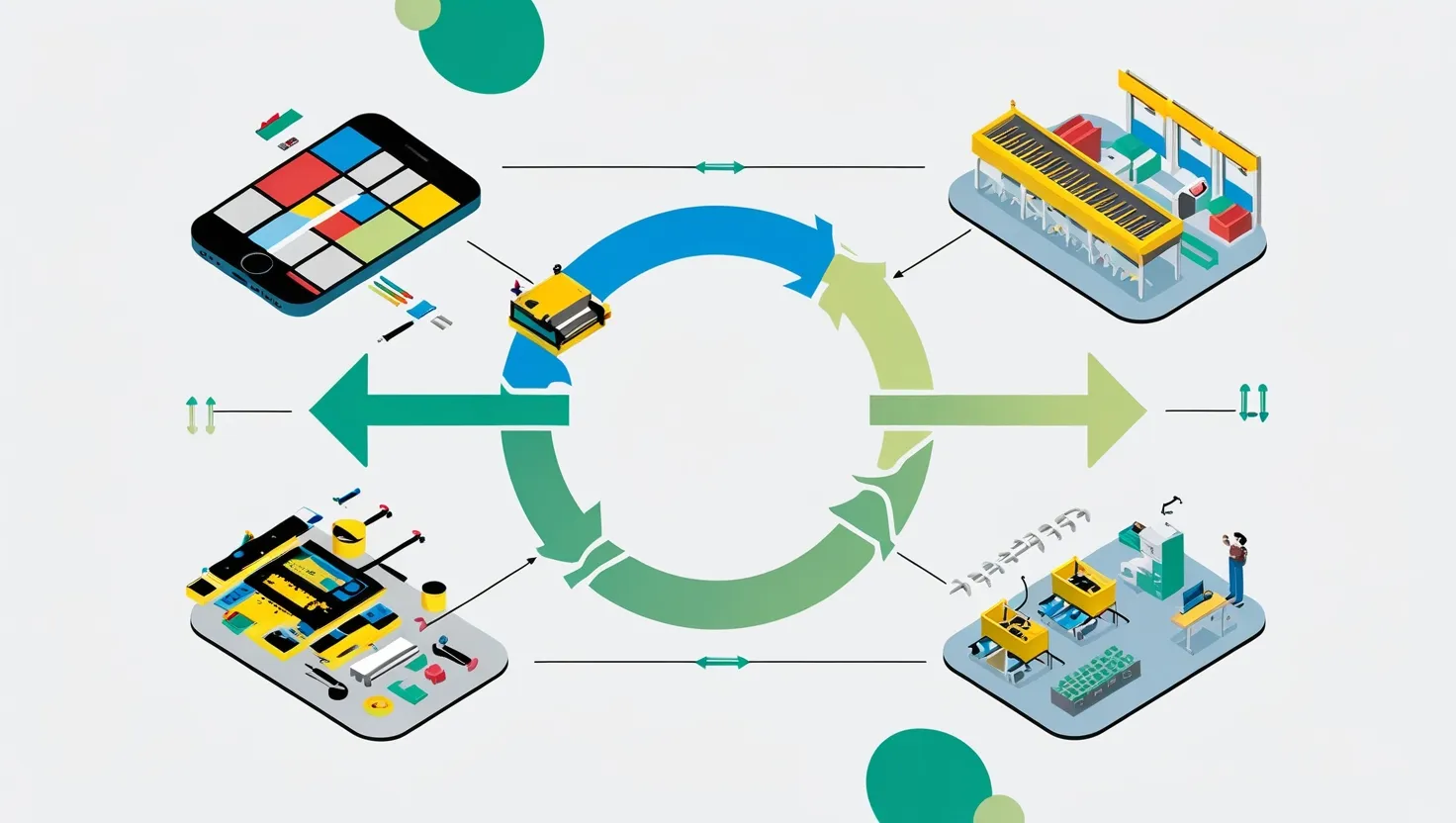

Imagine this: you’re throwing away an old phone, but instead of it rotting in a landfill, that same phone gets fixed up and sold to someone else, making money for the company. That’s the magic of circular economy business models. They take waste—stuff we usually toss—and turn it straight into cash. No more one-and-done products. Everything loops back around. Let me walk you through five smart models that companies use to do just that. I’ll keep it simple, like we’re chatting over coffee. Stick with me, and you’ll see how you can spot these in your daily life.

First up, product-as-a-service. Forget buying stuff outright. Pay for what you use, and the company keeps ownership. Why? So they can grab it back, fix it, and rent it again. Think of it like leasing a car, but for lamps or clothes.

Take Philips with their lighting. Hospitals don’t buy bulbs anymore. They pay per light turned on. Philips handles fixes and swaps. This way, they cut waste by reusing parts over and over. And guess what? They save 20-30% on materials because nothing sits idle.

“In a circular economy, products are designed to last, be repaired, reused, and recycled—not thrown away after one use.” – Ellen MacArthur, circular economy pioneer.

Ever rented a tux for a wedding instead of buying one? That’s the idea. Companies love this because they make steady money from subscriptions. You get what you need without clutter. But here’s a twist most folks miss: in baby clothes, Circos sends you outfits monthly. Kid grows? Send ‘em back clean. They wash and resend to the next family. No new clothes needed. Waste? Zero. Revenue? Keeps flowing.

What if your office furniture worked this way? Would you switch?

This model flips fear of waste into profit. Manufacturers design tougher products from day one. They know they’ll get them back. Lesser-known fact: in medical gear, Philips refurbishes old MRI machines. Hospitals trade in junk for discounts on new ones. Philips sells the fixed-up versions cheap to smaller clinics. Everyone wins, and rare metals stay out of dumps.

Next, repair and refurbishment platforms. Products break? Don’t bin them. Fix and resell. This stretches life way longer.

Patagonia’s Worn Wear is gold here. Send your torn jacket back. They mend it like new—patches, stitches, the works. Then certify and sell it online. They make cash from repairs and used gear. Customers pay less for quality stuff. Patagonia even runs repair shops in stores. Fun angle: they teach you to fix your own gear with free guides. Builds loyalty.

But dig deeper. Re-Tek in the UK grabs old IT from big firms. They remarket 80% as-is or fixed. Share profits with the old owner. The last 20%? Parts harvested or recycled. Landfill dodge: 99%. Imagine your dusty laptop funding the next guy’s setup.

“Repair is not just fixing; it’s rebirthing value from what seems dead.” – A repair advocate from the right-to-repair movement.

Question for you: Got a gadget gathering dust? Could a repair shop turn it into cash for you?

Unconventional view: This fights “planned obsolescence,” where companies make things break fast on purpose. Refurb pushes back. In fashion, H&M collects your old tees via I:CO. Sort into reworn, reused, or recycled. You get a voucher. They sell second-hand or spin into rags. Collected 29,000 tons last year. Revenue from vouchers pulls you back in-store.

Now, industrial symbiosis networks. One factory’s trash is another’s treasure. Link waste from one biz to inputs for another. No middleman dumps.

In Denmark, 25 companies swap extras. One’s leftover heat warms the next plant. Sludge becomes fertilizer. They cut costs on waste hauling and buying new stuff. Plus, spark new products. Aalborg East SMEs boosted energy savings and found fresh markets.

Protix in Holland? Food waste into bug larvae protein for pet food and fish feed. Built a huge factory on €35 million. Turns scraps most toss into high-value grub. Lesser-known: black soldier flies eat waste fast, then get harvested. Sustainable feed without farms.

“Waste is food in nature; why not in business?” – Inspired by Janine Benyus, biomimicry expert.

Picture this: your coffee grounds feeding mushrooms next door. Ever seen a factory neighborhood like that? Symbiosis scales it. RGS90 in Denmark crushes old insulation and porcelain into new ROCKWOOL panels. Construction junk reborn. Saves energy big time.

Challenges? Coordinating trucks for swaps. But pilots start small. Audit your waste first. Match with locals. Revenue pops from selling “waste” as resource.

Fourth, modular design principles. Build products like Lego. Snap apart, upgrade one piece, recycle the rest. Easy end-of-life.

Phones with swappable batteries? Dream. But Fairphone does it. Modules pop out. Fix or recycle solo parts. Cuts e-waste. In turf, Re-Match shreds old fields into clean rubber, sand, fibers. 100% reuse into new turf or panels.

Bricks too. Danish firms vibrate-clean old ones. Robots stack ‘em. Ships to sites. Saves 95% energy vs. new bricks. Pass resources generation to generation.

Here’s the hidden gem: Urban Mining Co recycles rare earth magnets from hard drives. Patented process makes custom new ones. Stuff usually landfilled now funds tech.

Ask yourself: If your watch battery swapped easy, would you keep it forever?

This model future-proofs against shortages. Rare metals scarce? Modularity recovers them clean.

Last, take-back programs. You use it, return it. Company recovers materials at end.

H&M again, but deeper. Vouchers lure returns. I:CO sorts for resale or fibers. Mr Green Africa buys Kenyan plastic waste, pellets it by color. Sells to makers. Funded to grow.

Netlet grabs construction surplus. Discounts via app and stores. Cuts site waste. Konecranes offers crane lifecycle care—maintain, modernize. No early grave.

“Closing the loop isn’t charity; it’s the smartest business move.” – William McDonough, cradle-to-cradle author.

Automotive twist: car makers take back batteries for EV reuse. Fashion: Patagonia pulls worn gear for remake. Electronics: Philips trades medical machines.

Outcomes? 20-30% material savings. New sales 5-15% of old. Electronics sector leads—refurb IT diverts tons.

But hurdles exist. Reverse logistics—getting stuff back—costs upfront. Trucks, sorting. Consumer habits: we love new shiny. Fix? Incentives like discounts. Start with audits: map your waste streams. Pilot one partner.

Globechain’s B2B marketplace lists office junk. Firms request, collect. Fees fund it. Multi-industry: hotels to retail.

BAMB treats buildings as material banks. Tracks value from build to demo. Data swaps.

Sharing sneaks in too. Construction shares bulldozers. Idle assets earn.

Why care? Resources dwindle. Rules tighten. Circular dodges scarcity.

You see it in fashion: Circos baby subs. Or Plus Pack’s food packaging-as-service. Reuse loops cut CO2 60%.

Construction: old bricks reborn.

Pets: Protix bugs from waste.

Healthcare: refurbished scanners reach poor clinics.

Interactive bit: Which model fits your job? Waste audit tomorrow?

Patagonia’s repair revenue rivals new sales lines. Philips lights-as-service scales global.

Fashion trades textiles for insulation.

IT: 99% landfill-free.

Plastics: pellets from trash.

Turf: full recycle.

These aren’t green dreams. Real cash. Companies redesign loops. You can too.

Start small. List your trash. Find a matcher. Pilot repair.

Future? Data coordinates chains. AI spots symbiosis.

We’ve covered five: service, repair, symbiosis, modular, take-back. Each turns waste to revenue.

Patagonia: “We’re in business to save our home planet.” They do, profitably.

Philips: Usage pay keeps lights eternal.

Danish swaps: Growth via giveaways.

Fairphone: Modular freedom.

H&M: Return for reward.

Pick one. Try it. World changes one loop at a time.

What waste in your life could pay you back? Think on it.

(Word count: 1523)